Untangling legal technicalities: electronic signature vs electronic seal

Electronic signature and trust services market is steadily consolidating in Europe. Their adoption, while not yet mainstream, is growing across all industries. The more popular the mechanisms of electronic signature become, the more we need to fully understand the legal technicalities around it. In this article, we will put the spotlight on a similar concept to electronic signature, yet not equally understood: the electronic seal.

What is an electronic seal?

It is a legal concept introduced in eIDAS Regulation to enable legal entities (such as companies, institutions, organisations) to sign electronically documents. Article 3 of the Regulation provides us with the legal definition: ‘An electronic seal’ refers to any data in an electronic form, which is attached to or logically associated with other data in electronic form, to ensure the latter’s origin and integrity. In other words, an electronic seal is the electronic equivalent of the classic company rubber stamp which certifies and protects the data’s origin and trustworthiness.

Signature and electronic seal: striking similarities and subtle differences

Technically speaking, an electronic seal relies on the same mechanisms as an electronic signature. However, unlike an electronic signature, an electronic seal does not imply a commitment or engagement from the signatory over the content of the document, apart from guaranteeing its data authenticity and origin. The striking similarities and subtle differences between these two concepts could, unfortunately, lead to confusion, so let’s have a closer look at them!

Electronic seal and electronic signature: two peas in the same (tech)pod?

Just like an electronic signature, an electronic seal can be advanced or qualified. These forms have to meet similar eIDAS requirements as an advanced or qualified electronic signature. This means that either an advanced electronic seal or a qualified electronic seal must be linked to the signer’s identity and capable of clearly identifying their creator who has under his sole control the electronic seal creation data. In addition, these types of electronic seal should be able to detect any changes in the documents after sealing, guaranteeing thus the integrity of the data. You can review the e-signature levels and their related eIDAS requirements here!

The electronic seal shares the same legal acceptance and recognition in all European Union’s (EU) member states as the electronic signature. This means that it cannot be denied as evidence in case of litigation solely on the grounds that it is an electronic form or that it does not meet the requirements for qualified electronic seals (Section 5, Article 35 of eIDAS). We must point out that the qualified electronic seal is the only one enjoying the highest level of legal recognition and acceptance. Just an in the case of a qualified electronic signature, the validity of a qualified electronic seal is presumed and once it is issued in one member state it cannot be dismissed in another member state.

Where does an e-seal stand out compared to e-signature?

Despite sharing numerous traits with an electronic signature, an electronic seal distinguishes itself by facilitating automation. Unlike electronic signature, where direct actions of the signer are required, electronic seals can be applied both manually and automatically, simplifying many of companies’ processes.

Using an e-seal, companies can sign high volumes of data such as e-invoices generated through an accounting system, contract templates to be shared with multiple actors, paychecks etc. The e-seal is also advantageous in the context of the PSD2 (the revised Payment Services Directive EU 2015/2366), for instance, when a third party provider (TPP) sends a payment request to a bank.

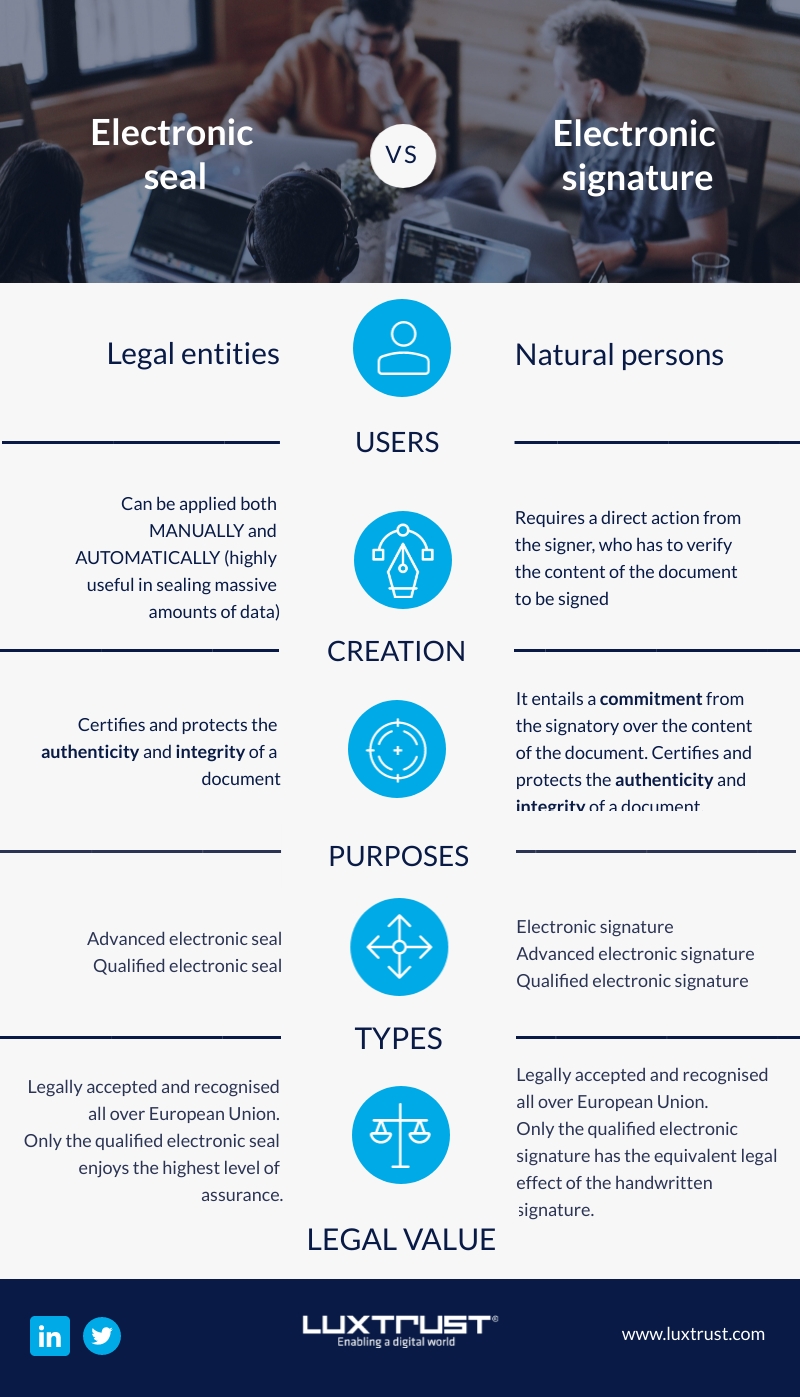

The infographic below sums up the main similarities and differences between electronic seal and electronic signature.

The above represents LuxTrust’s understanding of the relevant law or regulation and should not be taken, relied on or interpreted as a legal opinion. Customers are encouraged to seek independent legal advice before taking any action or decision based on this information. LuxTrust may not be held liable for damages that may result from the use and/or interpretation of the information contained in this document.